Learning how to budget for a cruise is the difference between a relaxing holiday and a stressful surprise at the end of the trip. Cruise ads usually show only the base fare, but once you add taxes, flights, hotels, drinks, Wi‑Fi and excursions, the true cost can be much higher.

This guide breaks down every major expense, shows you how to plan and track them step by step and highlights where to save or splurge so your cruise stays on budget and fun. If you’re still choosing your dates or itinerary, you might also like our guides on when to cruise, how to find the best cruise deals and how to choose the right cruise cabin.

Budget for a Cruise: Quick Overview

- Identify all cost buckets: base fare, taxes/fees, transport to port, pre/post stays, onboard spending, excursions, insurance, tips, Wi‑Fi, and souvenirs.

- Set a total budget, then assign caps to each category.

- Use a sinking fund and payment timeline to spread costs.

- Track spending live onboard to avoid surprises.

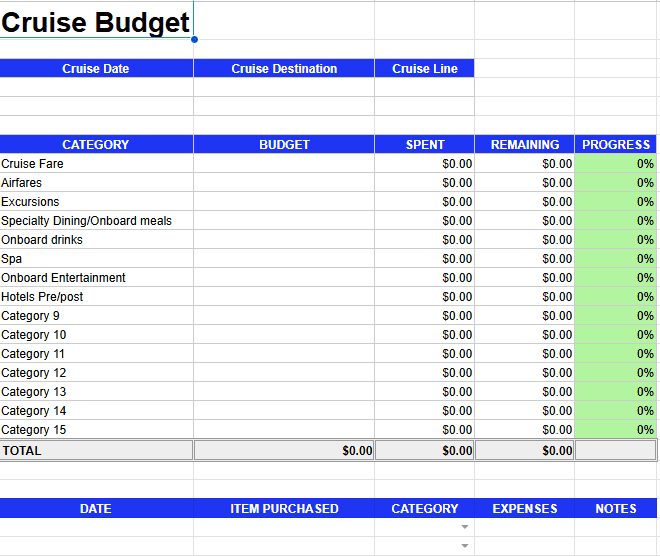

- Grab the included Google Sheets budget planner structure and checklist (instructions below) to manage everything in one place.

Tools We Use to Plan & Price a Cruise Budget

Before you finalise your numbers, it helps to see real prices for your specific route and dates. These are the sites we use when we budget for a cruise:

- Cruises – CruiseDirect: Compare multiple cruise lines, ships and sail dates side by side so you can see how the fare changes if you sail a week earlier or in shoulder season.

- Flights – KAYAK: Search flexible dates to find the cheapest days to fly to and from your embarkation port, then plug those costs into your cruise budget.

- Hotels – Booking.com: Check prices for pre‑ and post‑cruise stays near the port; even one extra night can change your total trip budget.

- Tours & shore days – GetYourGuide: See typical prices for shore excursions so you can set realistic per‑port caps.

- Travel money – Wise travel card: Avoid hidden foreign transaction and exchange fees when paying deposits, balances and onboard charges in different currencies.

What Makes Up the Total Cost of a Cruise?

Cruises advertise the base fare, but the full cost includes:

- Base fare: your cabin price, often per person, double occupancy.

- Port fees and taxes: mandatory charges added at checkout although many cruise line will include these in the base fare. Check before you book!

- Gratuities: automatic tips per person per day (varies by line).

- Transportation: flights, gas, parking, transfers or rideshares.

- Lodging: pre/post-cruise hotel nights (recommended if flying in).

- Onboard spending: drinks, speciality dining, spa, casino, photos, Wi‑Fi, onboard shops, laundry.

- Shore excursions: ship-run tours or independent operators.

- Travel insurance: medical, cancellation/interruption coverage.

- Miscellaneous: passports/visas, gear, souvenirs, currency exchange and foreign transaction fees (a multi‑currency card like the Wise travel card can reduce these).

Set Your Total Budget (And Make It Realistic)

- Define your ceiling: What’s the maximum you want to spend door-to-door?

- Work backward: Allocate percentages to each category (sample below).

- Choose priorities: If food and private excursions matter most, reserve more for those and trim elsewhere.

- Add a buffer: 10–15% contingency protects you from surprises.

Sample Budget Allocation (For a 7-Night Cruise)

- Base fare + taxes/fees: 45–55%

- Transportation (flight/parking/transfers): 15–25%

- Onboard spending (drinks, dining, activities): 10–15%

- Shore excursions: 10–15%

- Travel insurance: 2–4%

- Gratuities: 3–5%

- Wi‑Fi and communications: 1–3%

- Souvenirs and photos: 2–4%

- Buffer: 5–10%

Tip: The shorter the cruise or the closer the port, the more you can shrink transportation and boost onboard or excursion budgets.

Choosing Itinerary, Ship, and Cabin With Budget in Mind

- Time of year: Shoulder seasons (e.g., late spring, fall) often cost less than holidays or summer.

- Ship class: Newer mega-ships can cost more; older ships can be great value.

- Cabin type: Interior is cheapest, balcony adds comfort/views, suites offer perks but jump in price.

- Itinerary length: Longer cruises can lower per-night rates but increase total spend.

- Departure port: Driving to a port can save big versus flying.

Once you’ve narrowed down your preferences, use CruiseDirect to compare different ships, cabins and dates side by side. Our guide on how to choose the right cruise and how to choose the right cruise cabin goes deeper on trade‑offs between cost and comfort.

If you’re specifically comparing cruise lines from a comfort, inclusions and value perspective for mature travellers, our complete guide to the best cruise lines for seniors breaks down how different brands structure pricing and what’s genuinely included.

Transportation Costs: Flights, Parking, and Transfers

- Flights: Book 2–5 months ahead for domestic, 4–8 for international; watch fare alerts.

- Fly in a day early: Reduces risk and can save on last-minute rebooking chaos.

- Airport-to-port transfers: Compare cruise line shuttles vs. rideshares vs. third-party.

- Driving: Budget fuel, tolls, and port parking (often $15–30/day).

- Luggage and seat fees: Add them to your flight cost.

To keep your transport line item under control when you budget for a cruise, compare flight options on KAYAK and check port‑area hotels on Booking.com. If you’re adding a road trip before or after your cruise, you can price out rental cars on DiscoverCars to avoid last‑minute surprises.

Onboard Spending: Drinks, Dining, and More

- Drink packages: Worth it only if your daily consumption exceeds the per-day package price (including gratuities).

- Speciality dining: Choose one or two “experience” meals; book early for deals.

- Wi‑Fi: Buy pre‑cruise for discounts, or use a mix of a smaller onboard package and free/cheap port Wi‑Fi to cut costs. A VPN like Surfshark is worth considering if you’ll regularly use public networks in ports.

- Spa and activities: Look for port-day discounts when the ship is emptier.

- Casino and photos: Set a hard cap (and stick to it).

Shore Excursions: Ship vs. Independent

- Ship excursions: More expensive but vetted, with “ship won’t leave without you” peace of mind.

- Independent tours: Often cheaper, smaller groups; check reviews and timing guarantees.

- DIY days: Research walkable highlights; use public transit or hop-on buses to keep costs low.

- Mix and match: Splurge in one marquee port, go DIY in others.

When you’re comparing ship tours versus independent operators, sites like GetYourGuide make it easy to see prices, reviews and timings in one place. That helps you decide which ports to splurge on and where to plan cheaper DIY days.

Travel Insurance: Smart Risk Management

- What to cover: Medical (including evacuation), trip cancellation/interruption, baggage, delays.

- Policy sources: Cruise line vs. independent insurer (often broader coverage).

- As a rough guide, expect to budget around 2–8% of your total trip cost for travel insurance, depending on age, destination and coverage level. Because cruise policies vary widely by age, itinerary and medical history, it’s important to understand exactly what is — and isn’t — covered.We explain what to look for, including cruise-specific medical care, evacuation, pre-existing conditions and age limits, in our detailed guide to the best travel insurance for seniors going on cruises.

Tips, Gratuities, and Service Charges

- Automatic gratuities: Typically 1420 per person per day; verify the line’s current rate.

- Service charges: Some dining or spa services add 18–20% automatically.

- Cash tips: Keep small bills for porters, local guides, and exceptional service.

Hidden and Easy-to-Miss Costs

- Currency exchange and foreign transaction fees: Use a no‑FX‑fee card where possible. We recommend the Wise travel card as one of the best options for international travel and multi‑currency spending.

- Laundry or pressing: Pack wrinkle-release spray or use self-serve laundromats if available.

- Medical visits onboard: Your regular health insurance may not apply at sea.

- Photo packages: Plan before boarding—buy none, one, or cap your spend.

Budgeting Methods That Work

- Sinking fund: Save a set amount weekly/monthly into a dedicated account until sail date.

- 50/30/20 rule: 50% needs (fare, fees), 30% wants (dining, spa), 20% savings/buffer.

- Envelope method (digital or cash): Assign category caps; stop when an envelope is empty.

- Prepay where possible: Lock in rates and reduce onboard temptation.

If you prefer not to build your own spreadsheet from scratch, our free Cruise Budget Planner has all the main categories pre‑filled (fares, flights, hotels, excursions and more) so you can simply plug in numbers and see your total at a glance.

Live Tracking Onboard

- Use the cruise app or TV account to check your balance daily.

- Put a daily cap on your onboard spend and review before bed.

- Bring a prepaid gift card or cash for nonrefundable extras to avoid running up your credit card.

We like to jot down each day’s spending in our Cruise Budget Planner as well, so we can compare our actuals against the caps we set before sailing and adjust mid‑cruise if needed.

Example Cost Breakdown (Illustrative, 2 Adults, 7 Nights)

- Base fare + taxes/fees: $1,800

- Gratuities: $280

- Flights: $700

- Transfers/parking: $120

- Pre-cruise hotel: $180

- Drink package (1 adult only): $420

- Speciality dining: $120. The varies by ship and some will include in the base fare.

- Wi‑Fi: $105

- Shore excursions: $400

- Insurance: $120

- Souvenirs/photos: $150

- Buffer: $200

- 4,595

Adjust up/down by cabin type, itinerary, and travel distance.

Use this as a starting template when you budget for a cruise, then customise each line based on your itinerary, cabin choice and how far you need to travel to the port.

Ways to Save Without Feeling Deprived

- Book early-sale promos or last-minute deals (if flexible).

- Watch price drops and request re-fares before final payment.

- Choose interior cabins and spend savings on excursions.

- Bring refillable water bottles; enjoy included dining vs. speciality.

- Plan port days independently using trusted review sources.

To stack the odds in your favour, keep an eye on sales through CruiseDirect and read our guide on how to find the best cruise deals for specific strategies like tracking price drops and asking for re‑fares before final payment.

Where to Splurge (If It Matters to You)

- Balcony for scenic itineraries (Alaska, fjords).

- One special dining experience.

- A private tour in a bucket-list port.

- Photo with the whole family on formal night—just one, pre-budgeted.

Payment Timeline (Simple Plan)

- Reservation: Deposit + start sinking fund auto-transfers.

- 120–90 days: Book flights and hotel; buy insurance.

- 60–30 days: Final payment; pre-purchase Wi‑Fi, dining, or packages if discounted.

- 14–7 days: Confirm transfers, documents, and excursion tickets.

- Sailing week: Withdraw cash for tips and small purchases; set daily onboard caps.

When you budget for a cruise, it can also help to plan how you’ll pay at each stage: for example, using a rewards credit card with no foreign transaction fees for deposits and onboard charges, and a Wise travel card or local currency cash for everyday spending in port.

Common Budget Mistakes to Avoid

- Ignoring taxes, fees, and gratuities in the initial price.

- Waiting to buy insurance (coverage often best when purchased shortly after deposit).

- Overbuying drink packages “just in case.”

- Not checking your onboard account until the last night.

- Forgetting parking or luggage fees.

Pre-Cruise Budget Checklist (Mini)

- Confirm total trip budget and category caps.

- Reserve cabin class and itinerary aligned with budget.

- Price flights vs. driving; book pre-cruise hotel if flying.

- Decide on drink/Wi‑Fi packages (pre-purchase if discounted).

- Choose excursions (ship vs. independent) and book early.

- Purchase travel insurance.

- Set up a sinking fund and daily onboard caps.

- Prepare tip cash and a small emergency buffer.

Once you’ve ticked everything off, plug your numbers into the Cruise Budget Planner so you have your entire budget for a cruise in one place before you sail.

More Cruise Planning Guides

- Ultimate Cruise Tips: 15 Essential Tricks for a Stress‑Free Voyage

- When Is the Best Time to Cruise?

- How to Find the Best Cruise Deals: 5 Top Websites Compared

- How to Choose the Right Cruise

- How to Choose the Right Cruise Cabin