You’re dreaming of sandy beaches, buzzing city streets, or a quiet countryside escape—but you would rather not come home to a scary bank balance. Learning how to budget for a holiday isn’t about killing the fun; it’s about making sure your trip is amazing and financially comfortable.

With some simple planning and a few smart “holiday budget tips,” you can enjoy your time away without the guilt of overspending or relying on debt.

How to Budget for a Holiday: Start with Your Total Spend Limit

Before you start searching flights or hotels, step back and look at your overall financial situation. Any solid holiday budget begins with knowing your real limit.

Decide what you can truly afford

Ask yourself:

- How much do I already have saved for travel?

- How much can I realistically save before the holiday date?

- What amount can I spend without using high-interest debt?

You can use a simple formula:

Total Holiday Budget=Current Travel Savings+Future Savings Before Departure

Let this number guide where you go, how long you stay, and how fancy the trip feels. If the number feels too small, don’t ditch the idea of a holiday—adjust your trip budgeting by changing destination, season, or length instead.

Avoid using your credit card while on holiday. We ditched credit cards years ago and now only use a debit card. Adopt the strategy: If you don’t have the money now, then don’t buy it. There is nothing worse than coming home from a holiday and then having a credit card to pay off.

Break your budget into clear categories

Once you know your total, split it into key parts. This is a classic how to budget for a holiday move that helps you avoid accidental overspending:

- Flights / main transport

- Accommodation

- Food & drinks

- Local transport (buses, trains, trams, taxis, rideshares)

- Activities & tours

- Souvenirs / shopping

- Travel insurance

- Emergency buffer (at least 5–10% of the total)

Example for a $1,800 holiday:

- 35% flights = $630

- 30% accommodation = $540

- 15% food = $270

- 10% activities = $180

- 5% local transport = $90

- 5% buffer = $90

You can tweak the percentages, but the idea is the same: every pound, euro, or dollar has a job before you spend it.

Turn Your Holiday Budget into a Daily Spending Plan

A great trip budgeting guide doesn’t stop at a total number; it gives you a clear daily figure too.

Calculate your daily holiday budget

Focus on variable costs—food, local transport, activities, and small extras—then spread them across your trip length:

Daily Budget=Total Variable Costs/Number of Days

This daily amount works like a simple “speedometer” for your spending. If you go over one day, you can pull back the next.

Research realistic local prices

Prices vary dramatically by destination. To make your holiday budget tips actually work, you need real numbers:

- Search for average daily travel costs in your chosen city or country.

- Check several sources (tourism sites, blogs, guides like Nomadic Matt).

- Look specifically at:

- Average meal prices

- Public transport fares or typical taxi/ride costs

- Typical entry fees for main attractions

If your planned daily budget is far lower than the local average, revise your plan now—before your card gets a shock on arrival.

Cut Big Costs First: Transport and Accommodation

Most of the savings in any holiday budget plan come from major expenses, not minor sacrifices. Focus on flights and accommodation first.

Save money on flights and long-distance travel

To budget for a holiday without overspending, aim to reduce your biggest line item:

- Be flexible with your travel dates—midweek or shoulder season flights are often cheaper.

- Consider nearby airports if transport into the city is convenient and affordable.

- Use price alerts and book when fares dip, not at the last minute in panic.

- A reasonable layover can cut costs; just avoid exhausting, awkward connections that eat into your holiday time.

Even a saving of 10–20% on flights can free up a lot of money for fun experiences on the ground.

Choose accommodation that fits your priorities

Accommodation is another big piece of your holiday budget. Small daily differences quickly add up over the course of a trip.

- Compare quality hotels, boutique properties, serviced apartments, and well‑reviewed holiday rentals that match your comfort expectations.

- Consider staying slightly away from the busiest tourist areas if the location is quieter, safer, and still has reliable transport or easy access to key sights.

- Look for value‑adding inclusions such as breakfast, on‑site dining, reliable Wi‑Fi, lift access, concierge or reception support, and laundry facilities to make your stay more comfortable and convenient.

Ask yourself:

“Am I going on this holiday to enjoy the hotel, or the destination?”

If you’ll be out exploring most of the time, a clean, safe, simple place might be perfect—and far cheaper than a luxury resort.

Smart Spending on Food, Fun, and Local Transport

You can still have an amazing trip while keeping a close eye on the three areas where holiday spending often gets out of control: food, activities, and getting around.

Eat well without killing your budget

Here are practical holiday budget tips for food:

- Plan for one special or “splurge” meal a day and keep the others simple.

- Use local supermarkets and markets for breakfasts, snacks, and picnic lunches. Choosing accommodation with included breakfast can be a great saving and cut down what you spend on meals.

- Eat where locals eat—walk a few streets away from major attractions.

- Limit expensive drinks in tourist bars; enjoy them occasionally, not constantly. If you are staying at one place for more than a couple of days, then consider buying your own drinks. We did this on our recent trip to Koh Phangan and bought our own spirits and mixers to make cocktails which we could enjoy by the pool. It’s a huge saver when you consider what most places will charge for cocktails and other drinks.

You’ll still get great food experiences, but without letting eating out wreck your trip budgeting.

Prioritise your must‑do activities

You can’t (and don’t need to) do everything.

- List all the things you’d love to do on your holiday.

- Mark each item as:

- Must‑do

- Nice‑to‑do

- Optional / skip if needed

- Look up prices and add them to the activities and tours section of your budget.

Book key activities in advance if it’s cheaper or if they sell out, but leave space for spontaneous, low‑cost fun like beaches, hikes, markets, and parks.

Use local transport strategically

Getting around can be surprisingly expensive if you rely on taxis without thinking.

- Research public transport passes (daily or weekly) before you arrive.

- Group attractions by area so you walk more and ride less.

- Use taxis or rideshares when it’s late, unsafe to walk, or distances are large—not as your default.

This approach is core to any how to budget for a holiday strategy: small daily savings that add up without reducing enjoyment.

How to budget for a holiday in Practice: Saving and Tracking Systems

Knowing your numbers is one thing; sticking to them is another. That’s where simple systems help you manage your holiday budget in real life.

Automate your holiday savings

Once you’ve set a target, make saving almost effortless:

- Open a separate savings account just for travel.

- Set up automatic weekly or monthly transfers.

- Add unexpected money—bonuses, refunds, gifts—straight into this account.

A dedicated “Holiday Fund” makes it much clearer how close you are to affording your amazing trip and protects that money from day‑to‑day spending.

Track your spending while you’re away

A realistic trip budgeting guide always includes tracking:

- Use a budgeting or travel expense app, or even a simple notes app.

- Log what you spend each day on food, transport, and extras.

- Check your total against your daily budget each evening.

If you overspend one day, consciously cut back a little the next. This gives you control without feeling deprived.

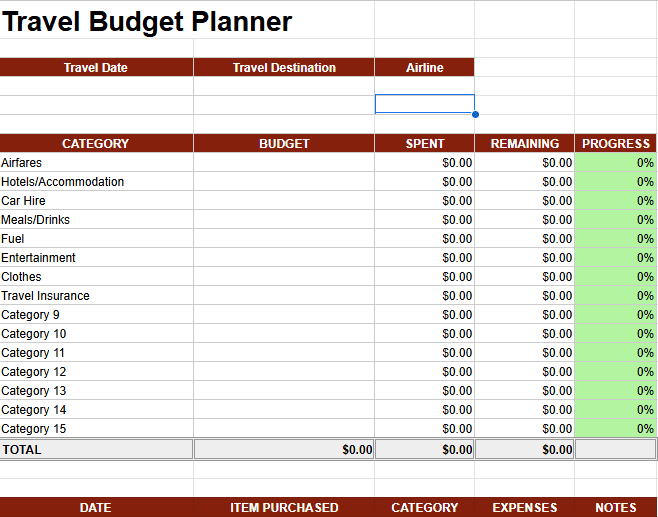

We designed our own budget planner, which is a simple one-page digital planner you can use to budget and track all of your expenses. We are happy to share it with anyone and you can download it for free below.

Protect Your Plans: Insurance and an Emergency Buffer

Even the best holiday budget plan can be disrupted by surprises. Factor in protection from the start.

Include travel insurance from day one

Avoid the temptation to skip insurance to save money. If something goes wrong, it can be devastating financially.

Look for cover that includes:

- Medical emergencies and hospital care, particularly if you are travelling overseas where any domestic health insurance benefits may not be available

- Trip cancellation or interruption

- Lost, stolen, or delayed luggage

- Emergency evacuation or transport

Treat insurance as a core part of your how to budget for a holiday equation, not an optional add‑on.

Keep an emergency buffer

Set aside at least 5–10% of your total budget for true emergencies:

- Unexpected accommodation costs

- Medical needs

- Last‑minute transport changes

Keep this in a separate account or clearly labelled in your budgeting app as “Emergency Only”. Ideally, you won’t touch it—but knowing it’s there lets you relax and enjoy your holiday.

By deciding your total budget upfront, breaking it into clear categories, researching real costs, and tracking your spending as you go, you’ll master how to budget for a holiday that’s both enjoyable and financially sensible. You don’t need to choose between an amazing trip and a stable bank balance—you can have both, with a thoughtful plan and a few simple habits.

See our other planning guides here